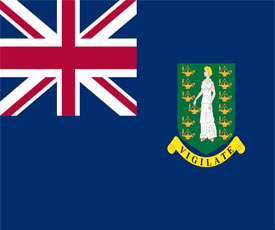

The British Virgin Islands is the most active offshore zone, where the number of registered companies exceeds the population by several times. Against the background of recent international rules on mandatory confirmation of their economic presence, foreign investors have quite a logical question — where to get so many offices for each legal entity in the BVI? Offshore companies in BVI are spreading due to optimal business conditions. That said, the OECD requirement for proof of economic presence, can lead to business outflows. The British Virgin Islands is a self-governing British crown jurisdiction, with one of the longest-running offshore territories. Although administered independently, BVI jurisdictions are subject to British laws, the main language is English.

The British Virgin Islands is the most active offshore zone, where the number of registered companies exceeds the population by several times. Against the background of recent international rules on mandatory confirmation of their economic presence, foreign investors have quite a logical question — where to get so many offices for each legal entity in the BVI? Offshore companies in BVI are spreading due to optimal business conditions. That said, the OECD requirement for proof of economic presence, can lead to business outflows. The British Virgin Islands is a self-governing British crown jurisdiction, with one of the longest-running offshore territories. Although administered independently, BVI jurisdictions are subject to British laws, the main language is English.

Because of the tax-free rules, foreign entrepreneurs continue to actively buy and form new IBC companies, including in the British Virgin Islands. Company registration has not lost its relevance for many reasons, primarily the lack of taxation in the country. There are no capital gains taxes, corporation tax, income tax, sales tax/VAT, inheritance tax, no restrictions on doing business in any country in the world, expedited opening of companies within 48 hours. The list could go on, but the main points of benefit to the businessman are already clearly visible.

Offshore companies in BVI and how to set them up

Both an individual and a legal entity, including non-resident of the island state, can register a company in the BVI. In order not to overstep the established legal regulations, registration activities are carried out in accordance with the British Virgin Islands Companies Act, 2004 (ed. 2005), the full version of which can be found on the official website of the BVI Financial Services Regulator, the British Virgin Islands Business Companies (Amendment) Regulations 2019 and the Beneficial Ownership Secure Search System Act, 2017. Registration of a company in the BVI is done through a registered agent. This allows, among other things, to open a company without the personal presence of the founder. Our company offers you assistance in the following tasks:

- Preparation of documents for the registration of offshore companies in the BVI;

- The provision of addresses and the registration of companies in the territory of the BVI;

- Legalization of documents of the company, obtained during the creation of the company;

- Assistance in financial accounting, as companies shall keep financial documents to explain the company transactions;

- The cost of company registration costs from 2500 euros, the cost depends on the services required from us. Please note that from July 1st 2021 the Registry has introduced a fee for all original certificates and documents. Thus, if an original certificate of incorporation is required, there will be an additional $150 fee;

- When submitting documents for company registration, there are certain requirements for the documents, namely certification of certain documents by a notary in your state, when preparing the documents, all specifics will be communicated to the client;

- It is possible to get a nominal service for the companies;

- Other services on request of the client.

If you still have questions, please write us in the chat, in the lower corner of the screen, or send an e-mail to our company. You can also use the feedback form you can see below for a prompt legal response:

Offshore companies in BVI for business development

Companies located in a highly favorable region promote both small and large businesses. A fast-track clearance process will help you get up and running quickly and implement the plans you have for your company. It is worth noting that commercial companies registered in the BVI, according to Article 98 of the «Companies Act» are required to have all financial documents, reflecting with maximum accuracy its financial position and allowing sufficient explanation of the company's transactions. Documents may be kept either in written form or electronically in compliance with the Electronic Transactions Act. Failure to comply with the Law will result in a fine of USD 10,000. Our team will assist you in setting up a company, keeping financial records, filing reports (if necessary), and offer support in dealing with BVI state structures.